Blog

Closing a business involves a number of tax responsibilities

While many facets of the economy have improved this year, the rising cost of living and other economic factors have caused many businesses to close their doors. If this is your situation, we can help…

If your business has co-owners, you probably need a buy-sell agreement

Are you buying a business that will have one or more co-owners? Or do you already own one fitting that description? If so, consider installing a buy-sell agreement. A well-drafted agreement can do these valuable…

Be aware of the tax consequences of selling business property

If you’re selling property used in your trade or business, you should understand the tax implications. There are many complex rules that can potentially apply. To simplify this discussion, let’s assume that the property you…

Consider borrowing from your corporation but structure the deal carefully

If you own a closely held corporation, you can borrow funds from your business at rates that are lower than those charged by a bank. But it’s important to avoid certain risks and charge an…

2024 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply…

Hiring your child to work at your business this summer

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages. Benefits…

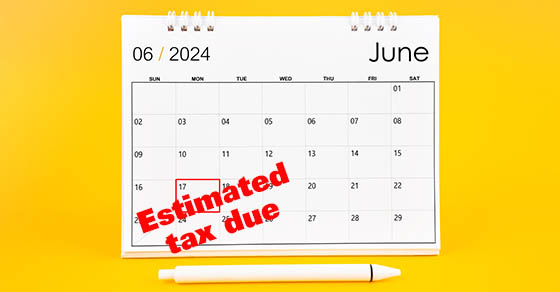

Figuring corporate estimated tax

The next quarterly estimated tax payment deadline is June 17 for individuals and businesses, so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the…

Inflation enhances the 2025 amounts for Health Savings Accounts

The IRS recently released guidance providing the 2025 inflation-adjusted amounts for Health Savings Accounts (HSAs). These amounts are adjusted each year, based on inflation, and the adjustments are announced earlier in the year than other…

Emil @ CPA Contractors gives you Tax tips when buying the assets of a business

After experiencing a downturn in 2023, merger and acquisition activity in several sectors is rebounding in 2024. If you’re buying a business, you want the best results possible after taxes. You can potentially structure the purchase…

Should you convert your business from a C to an S corporation?

Choosing the right business entity has many implications, including the amount of your tax bill. The most common business structures are sole proprietorships, partnerships, limited liability companies, C corporations and S corporations. In some cases, a business…

The tax advantages of including debt in a C corporation capital structure

Let’s say you plan to use a C corporation to operate a newly acquired business or you have an existing C corporation that needs more capital. You should know that the federal tax code treats corporate debt…

Growing your business with a new partner: Here are some tax considerations

There are several financial and legal implications when adding a new partner to a partnership. Here’s an example to illustrate: You and your partners are planning to admit a new partner. The new partner will…